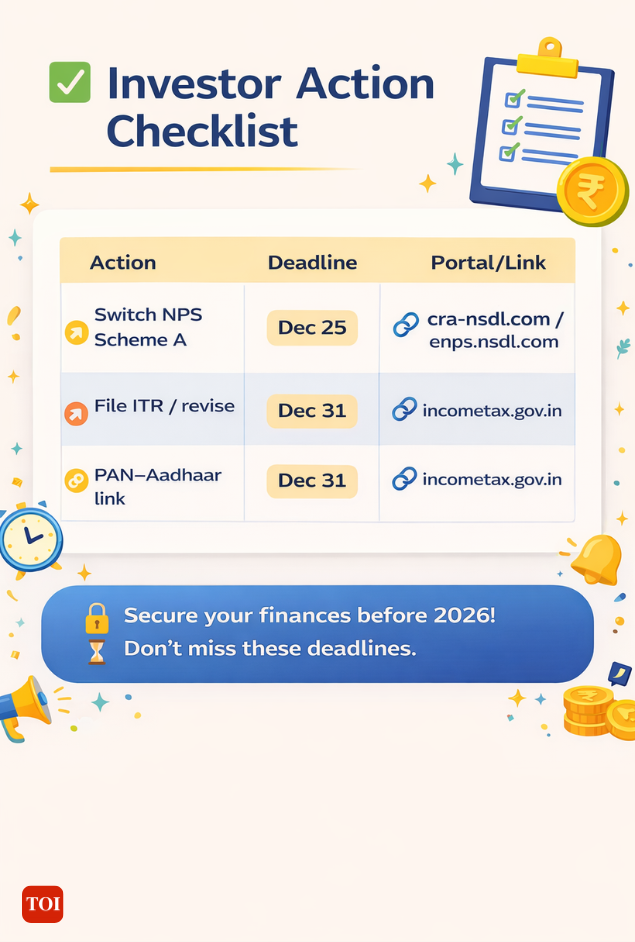

Two dates, three traps: How to fix your NPS, PAN and ITR before December 31

It’s the fourth week of December. It is the last and final chance to look at your financial to-do list for 2025.A pension scheme you picked years ago pops up with a deadline. A tax return you meant to revise “next weekend” is now starting on December 31. And in the background, PAN-Aadhaar compliance still trips up people who assumed it was “already done.”TL;DR: Driving the newsThis isn’t a “get rich in 2026” story. This is the boring, powerful stuff: File what must be filed, switch what must be switched, and keep your IDs clean so you don’t spend January fighting portals, penalties, and paperwork.Three very different deadlines are converging:

NPS Scheme A’s exit window (December 25)- Final

ITR submission or revision date (December 31) - Aadhaar–PAN intimation requirement for a specific group (December 31)

Then there is the issue of a policy nudge toward DIY investingMiss one, and you could lose money, tax breaks – or even get locked out of your own financial records.

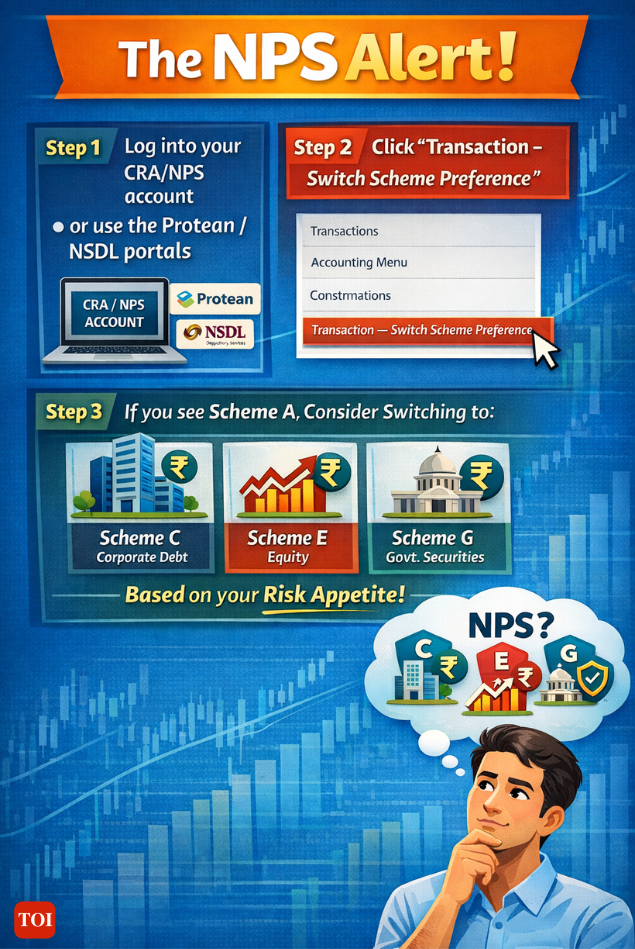

1. The NPS Alert: ‘Scheme A’ is being sunset – your move ends December 25

For most subscribers, the National Pension System is “set and forget.” That is precisely why a recent notice from the Pension Fund Regulatory and Development Authority matters.If you’re one of the 1.7+ crore Indians investing via the National Pension System (NPS), this affects a small – but vulnerable – segment of investors.

What’s happeningPFRDA is merging Scheme A (under Tier I, Active Choice) with other broader schemes. Why? Because Scheme A, which had exposure to “alternative” instruments like REITs, InvITs, AIFs, and structured debt, has a small corpus and limited diversification.The PFRDA says the merger will “improve liquidity, diversification and risk-adjusted outcomes” by pooling it with Schemes C and E – those focused on corporate debt and equities.Why you should careUnless you act by December 25, your allocation will be moved for you. But till then, you can voluntarily switch your portfolio without any additional cost.This is rare: Regulators don’t usually give a “free switch” window. And given that alternative investments can behave very differently during market stress, this is a chance to reset your retirement planning on your own terms.What to do

- Log into your CRA/NPS account (or use the Protean/NSDL portals)

- Click “Transaction – Switch Scheme Preference”

- If you see Scheme A, consider switching to Scheme C (corporate debt), E (equity), or G (government securities) based on your risk appetite.

Zoom in

- Under 40? Prioritize long-term growth – equity exposure should be intentional.

- Close to retirement? Liquidity and stability matter more than aggressive bets.

- Confused about what Scheme A even does? That’s reason enough to simplify.

One-liner to remember:You don’t want to wake up in January and find that your pension money moved into a scheme you didn’t pick – just because you missed logging in before Christmas.

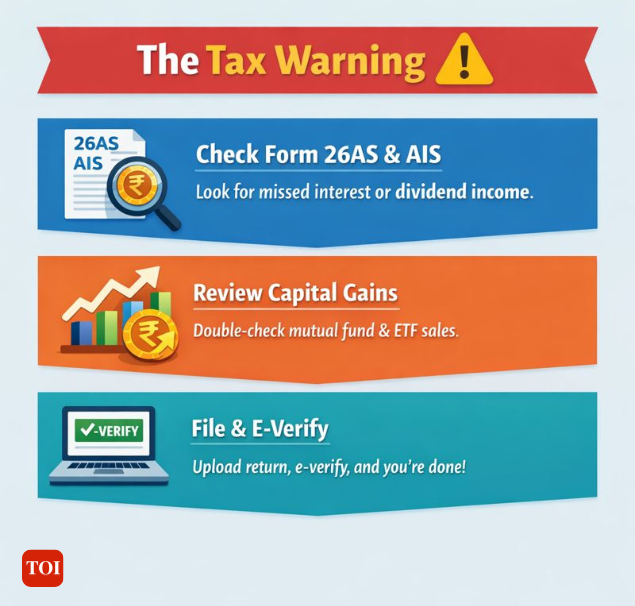

2. The Tax Warning: December 31 is the final, no-excuses wall for FY 2024–25

Applies to: Belated or revised ITRs for Assessment Year 2025–26 (FY 2024–25)Why this is a big dealThis isn’t a soft “recommended by” deadline. This is the last legally permitted date to fix tax filings if you:Missed the original due date (file belated return)Need to correct past errors (revise return)

The hidden cost of missing it:

- Late fee? Yes.

- Interest on tax dues? Yes.

- But the real pain is structural: You could lose the ability to carry forward capital, business or speculative losses.

According to Section 139(1) of the Income Tax Act, these losses are only allowed to be carried forward if the original return was filed on time or within this final window. Exception alert:

- Losses from house property can still be carried forward even if the original return was late.

But if you’re sitting on short-term stock losses, crypto red ink, or business write-offs, you can’t just say, “I’ll fix it later.”What happens if you miss December 31?You enter the ITR-U zone:

- Can be filed up to 48 months after the assessment year

- Can’t claim losses

- A penal tax applies

So yes, there’s a door – but it comes with a heavy price tag.Your action plan (for regular salaried taxpayers):Set aside 60–90 minutes before year-end.

- Check Form 26AS and AIS for missed interest/dividends

- Remember you can only file your ITR under new regime since it is a belated ITR.

- Review capital gains – especially mutual fund/ETF sales

- Upload, e-verify, done

Don’t forget e-verification. Many miss this last step and assume the return is complete when it isn’t.

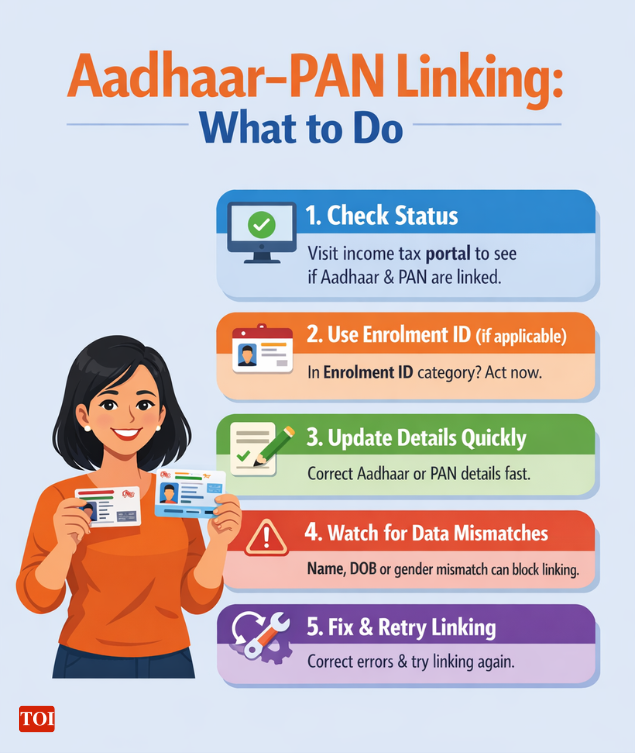

3. Aadhaar–PAN: A silent December 31 deadline – but only for some

Applies to: PAN holders who got their PAN using Aadhaar Enrolment ID (application before October 1, 2024)What CBDT says:If your PAN was issued on the basis of an Aadhaar Enrolment ID – not the Aadhaar number itself – you must intimate your Aadhaar before the end of 2025.This is separate from the June 30, 2023 linking deadline, which applied to everyone else.

Why it mattersAn “inoperative” PAN means:

- You can’t file returns

- Higher TDS gets deducted

- Refunds get delayed

- You may face rejections for investments, KYC, even fixed deposits

What you should do:

- Check your Aadhaar–PAN linking status on the income tax portal

- If you fall in this Aadhaar Enrolment ID group, update your details immediately

- If linking fails: mismatch in name/DOB/gender is the usual culprit → fix the data, then try again

4. A small savings signal hiding in plain sight

One December development looks minor until viewed in context.Answering a question in the Lok Sabha on December 15, 2025, minister of state for finance Pankaj Chaudhary said that commissions for small savings agents were reviewed keeping in view the government’s shift toward digital transactions.He also disclosed that commission outgo to MPKBY and SAS agents rose from Rs 2,324.15 crore in 2010–11 to Rs 4,149.77 crore in 2023–24, according to reported figures.The consumer takeaway is not that agents are villains. In many regions, they remain the primary interface for savers without easy digital access. The signal is simpler: distribution has a cost, and policy increasingly prefers self-service where possible.For savers, the practical question is whether they are using an agent out of necessity or inertia.

The one-page December money checklist

By December 25:NPS → Log in → If Scheme A → Decide and switch (no-cost window)By December 31:Tax return (belated or revised) → File and e-verifyAadhaar–PAN → Check if you fall into the Enrolment ID group → Link if neededOngoing:Small savings via agent? → Collect paperwork, prefer digital next timeCheck if your PAN is inoperative – fix immediately to avoid ripple effects

The bottom line

This December isn’t about FOMO trades or tax-saving hacks. It’s about quiet, powerful actions that clean up your financial pipes before the New Year.“Financial health isn’t just about chasing returns – it’s about stopping avoidable losses, blocked access, and regret-filled Januarys.”If you do nothing else this week:

- Check NPS Scheme A today

- Block a calendar slot for your ITR

- Look up your PAN-Aadhaar link status

- Review how you’re investing – and if agents are still needed

Sometimes, staying financially strong isn’t about what you gain. It’s about what you don’t lose.