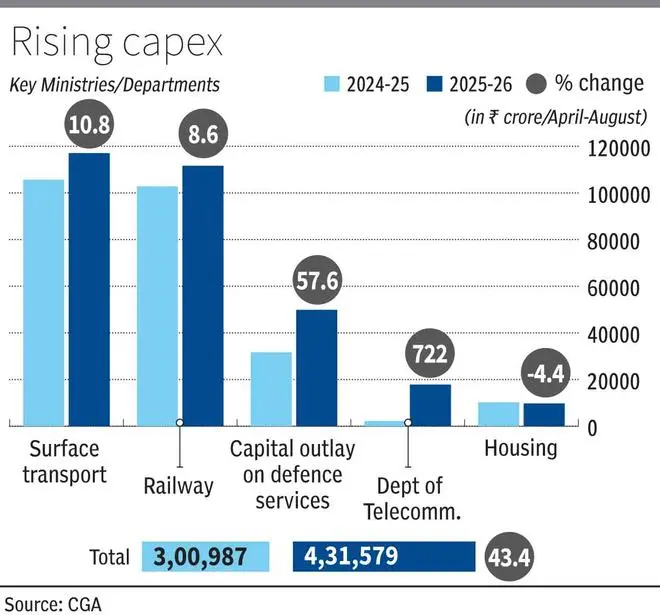

Frontloaded spending pushes capex 43% in April-August

The government has budgeted ₹11.21 lakh crore for capital expenditure this fiscal.

| Photo Credit:

PRAKASH SINGH

Capital expenditure surged by more than 43 per cent in the April–August period of FY26, aided by frontloading of spending and a favourable base, data from the Controller General of Accounts (CGA) showed on Tuesday.

Over the same period, the fiscal deficit widened to 38 per cent of the annual target, with tax revenues declining for a third consecutive month in August, as against 27 per cent in the corresponding period of the last fiscal.

Capital Expenditure

The government has budgeted ₹11.21 lakh crore for capital expenditure this fiscal. By end-August, it had spent ₹4.31 lakh crore — 38.5 per cent of the allocation, compared with 27 per cent in the same period last year when election-related factors kept spending subdued. Railways and roads drove the increase, while housing registered a decline.

Economists said the upfront spending provides a cushion for growth. Devendra Kumar Pant, chief economist at India Ratings, said that capex growth until end-August 2025 was “more than four times the budgeted growth”. He added: “Capex growth was aided by 175 per cent y-o-y growth in loans and advances till August-end.”

Aditi Nayar, chief economist at ICRA, highlighted the sharp rebound in August following a July dip: “After 11 per cent YoY dip in July, capex was more than doubled in August and that augurs well for economic activity in the quarter. The upfronting implies that capex can contract by as much as 8 per cent in the remaining seven months of FY26 and still meet the target, which may weigh upon the GDP growth momentum in the later quarters of FY26.”

Overall Fiscal

Weak tax revenues have added pressure on the fiscal front. Fiscal deficit between April and August stood at ₹5.98 lakh crore, against ₹4.35 lakh crore in the same period a year earlier. The Centre expects a full-year deficit of 4.4 per cent of GDP, or ₹15.69 lakh crore.

CGA data showed receipts of ₹12.82 lakh crore up to August, or 36.7 per cent of the budget estimate. Of this, ₹8.1 lakh crore came from net tax revenue, ₹4.4 lakh crore from non-tax revenue, and ₹31,970 crore from non-debt capital receipts.

Pant said the fiscal arithmetic now depends on how GST rate rationalisation affects consumption. “If the initial data on car sales in the festive season is an indication, there is a chance that the consumption demand will rise and will be able to compensate some of GST losses due to rate rationalisation,” he said. “However, it is too early to term initial festive season automobile sales as a general trend, a large part of it was due to pent up demand. If the revenue collections remain subdued, the government may look at rationalisation of expenditure to control deficit.”

Published on September 30, 2025